how to declare mileage on taxes

If youre using the standard mileage rate first calculate the value of your deduction. Do i have to pay tax on mileage reimbursement.

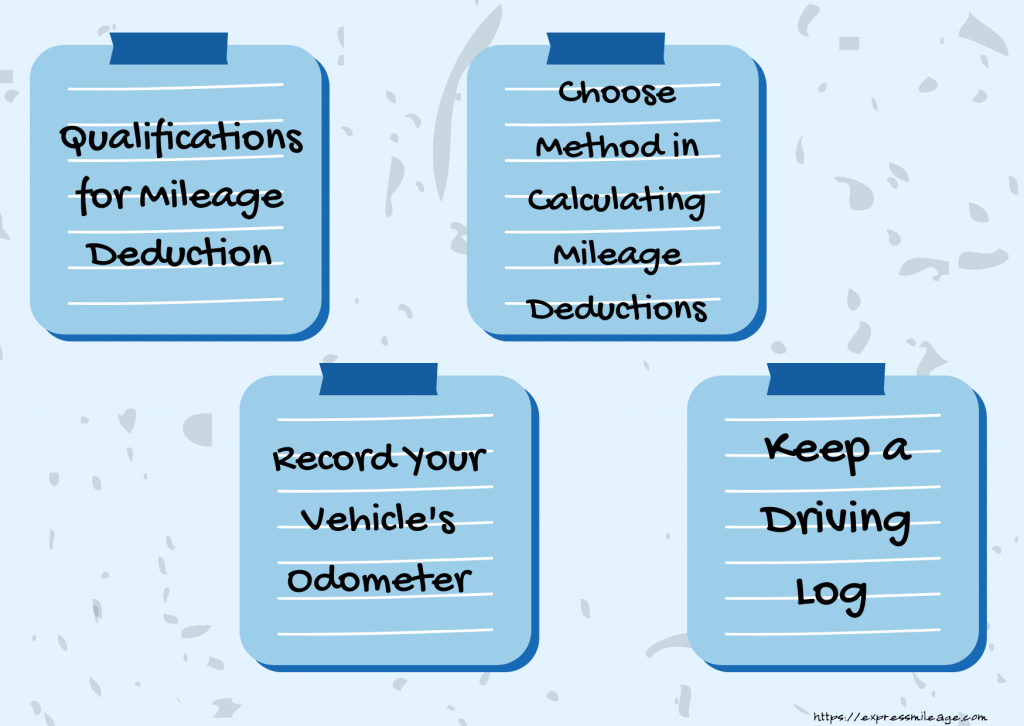

Learn To Log Business Mileage For Taxes Expressmileage

And Canada Dashers- To keep track of your total mileage and maximize your business-related deductions on your 2022 tax return we recommend using mileage tracking.

. How to I deduct doordash mileage from my earnings to pay Q3 taxes. If you are an employee you cannot deduct gas mileage as an unreimbursed expense on your tax return. In case you select the usual mileage deduction you need to hold a log of miles pushed.

How to claim mileage on taxes. You can also add your. The IRS Standard Mileage rate is the standard mileage reimbursement rate set by the IRS each year so that employees contractors and employers.

This is the easiest method and can result in a higher deduction. How to Log Mileage for Taxes in 8 Easy Steps 1. Multiply the standard mileage rate by your total miles driven or determine your actual expenses for the year.

Turning to the current tax year the IRS did make upward adjustments to some of their standard mileage rates. Deduct your mileage expense to lower your taxable income. To do this you need to itemize your deductions instead of claiming the standard deduction.

The standard mileage deduction. The IRS is kind of particular on this level. Determine Your Method of Calculation.

Typically the reimbursement stays non-taxable as long as the mileage rate used for reimbursement does not exceed the IRS. To use this method multiply your total business miles by the IRS Standard Mileage Rate for. The standard mileage rate is easy to calculate.

No Matter The Complexity Of Your Tax Situation TurboTax Helps You File With Confidence. Through the internal revenue service website at wwwirsgov you can learn the tabs of mileage deductions available for taxpayers. There are two ways to calculate mileage reimbursement.

Heres how to write off mileage on taxes. September 4 2020 1055 PM. If youre self-employed or an independent contractor however you can deduct mileage.

Do I subtract Mileage 575 cents and then take 22 of the remaining. At first of every journey the taxpayer should report the odometer. Ad Learn How To File Taxes From A Live Tax Expert With TurboTax Live.

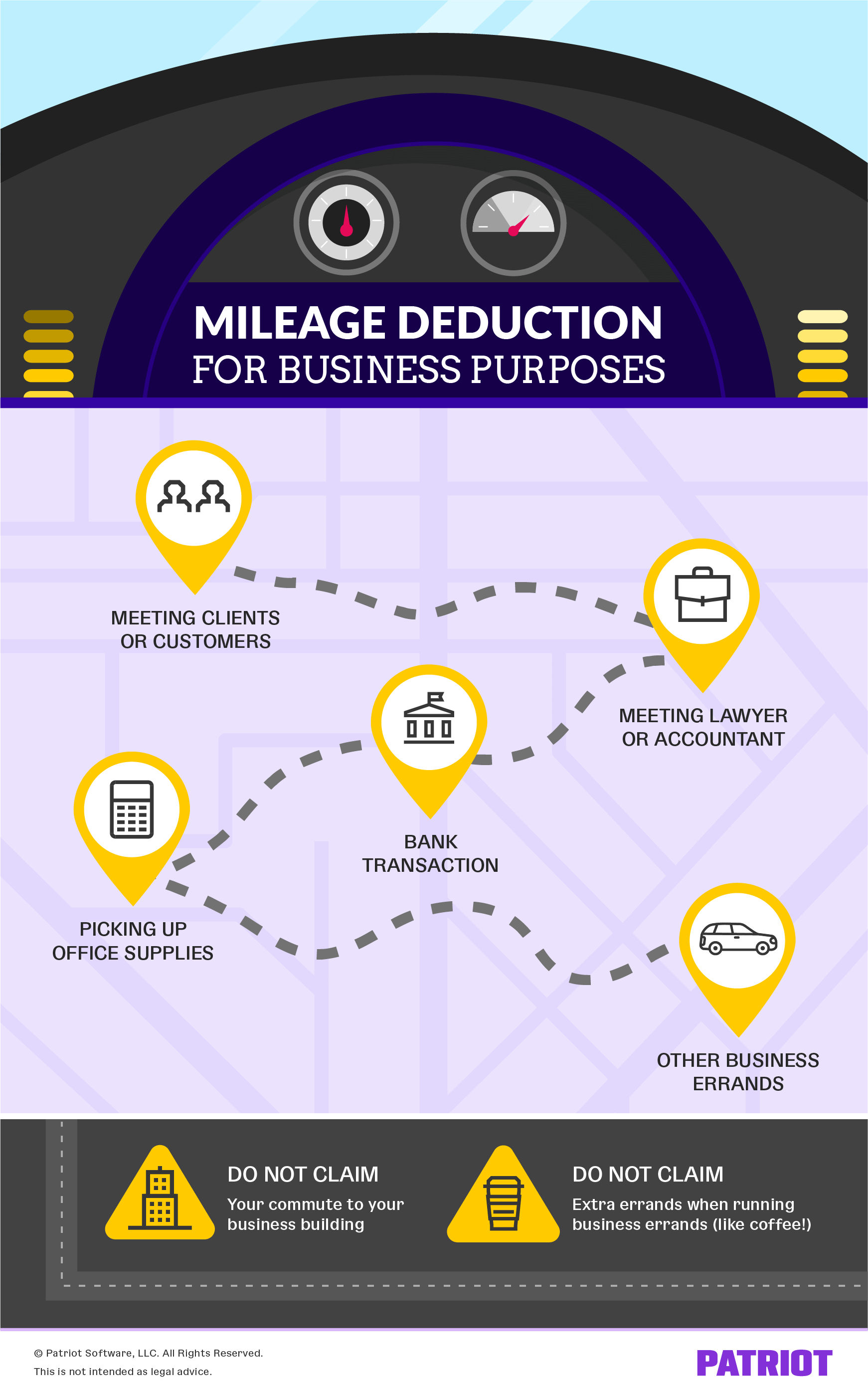

Make Sure You Qualify for Mileage Deduction. No Matter The Complexity Of Your Tax Situation TurboTax Helps You File With Confidence. Ad File 1040ez Free today for a faster refund.

IRS STANDARD MILEAGE RATE. Standard IRS Mileage Deduction. Ad Learn How To File Taxes From A Live Tax Expert With TurboTax Live.

For business mileage the 2022 rate is 585 per mile. You need to keep track of your total number of miles that you drove during the year and the total number of miles you drove for. The rate usually changes every year and therefore you will.

Mileage Deduction Guide For Self Employed Workers Triplog

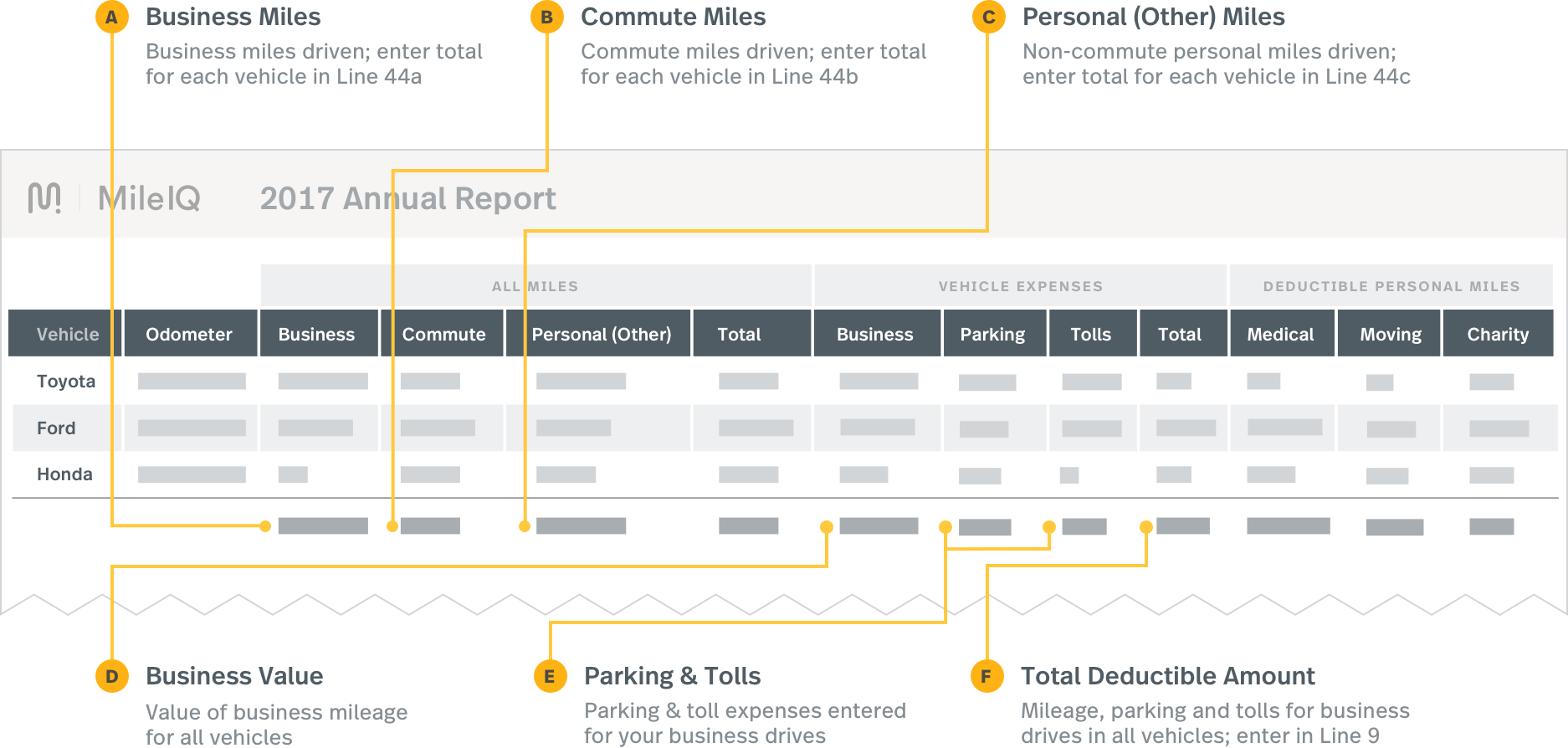

Reporting Mileiq Mileage With Tax Software Mileiq

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Free Mileage Reimbursement Form 2022 Irs Rates Word Pdf Eforms

![]()

25 Printable Irs Mileage Tracking Templates Gofar

What Business Mileage Is Tax Deductible

25 Printable Irs Mileage Tracking Templates Gofar

What Are The Mileage Deduction Rules H R Block

![]()

25 Printable Irs Mileage Tracking Templates Gofar

Free Mileage Log Template For Excel Everlance

Mileage Tax Deduction Claim Or Take The Standard Deduction

Here S What You Should Do If You Forgot To Track Your Mileage Expressmileage

How To Claim Mileage And Business Car Expenses On Taxes

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

What Are The Irs Mileage Log Requirements The Motley Fool

Learn To Log Business Mileage For Taxes Expressmileage

What Records Do You Need To Claim A Vehicle Mileage Deduction